michigan sales tax exemption rules

In Michigan certain items may be exempt from the. This Letter Ruling explains the application of the medical equipment exemption contained in the sales and use tax acts to orthotic devices.

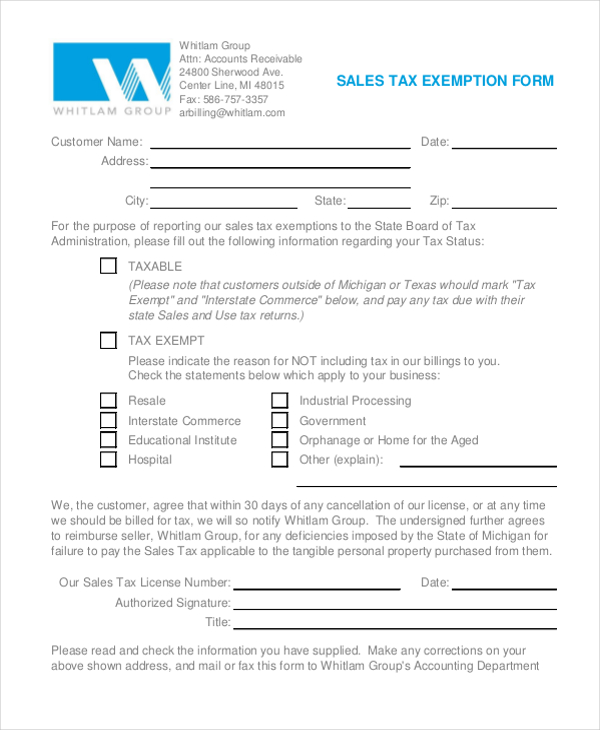

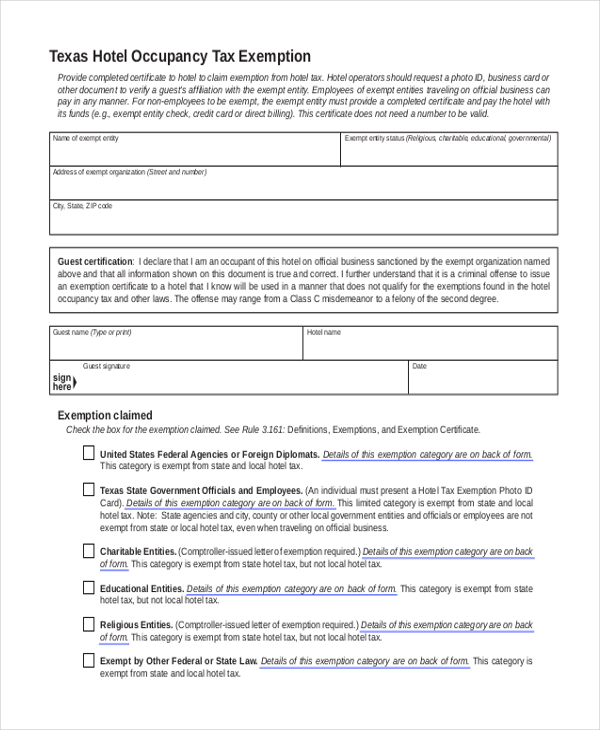

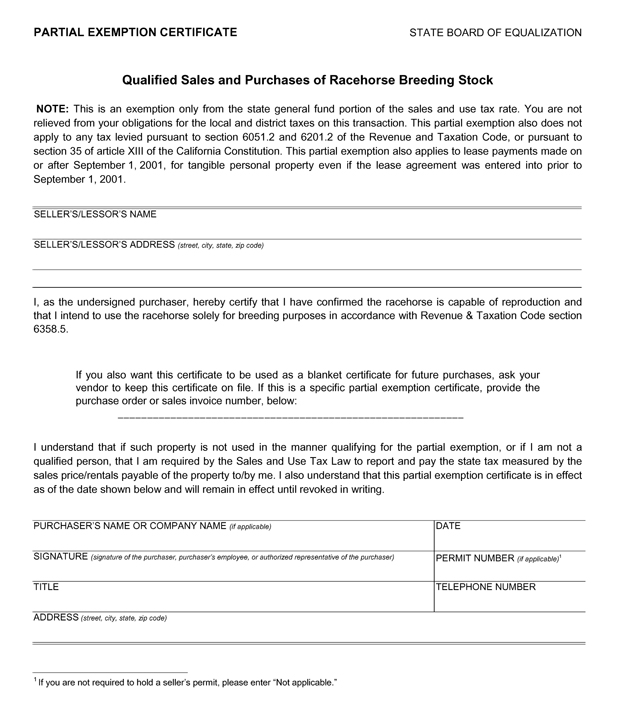

Free 8 Sample Tax Exemption Forms In Pdf Ms Word

RAB 2016-18 Sales and Use Tax in the Construction Industry.

. There are no local sales taxes in the state of Michigan. The purchase or rental must be for University consumption or use and the consideration for these transactions must move from the funds of the. Municipal governments in Michigan are also allowed to collect a local-option sales tax that ranges from 0 to 0 across the state with an average local tax of NA for a total of 6 when combined with the state sales tax.

For Resale at Wholesale. Church Government Entity Nonprofit School or Nonprofit Hospital Circle type of organization. Michigans Sales Tax Home Page Michigans Sales Tax Rules Identify the purpose use and location of manufacturing purchases which is an important internal control to ensure the proper administration of the sales tax.

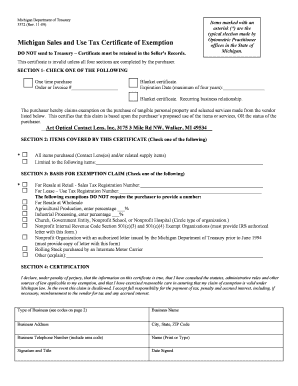

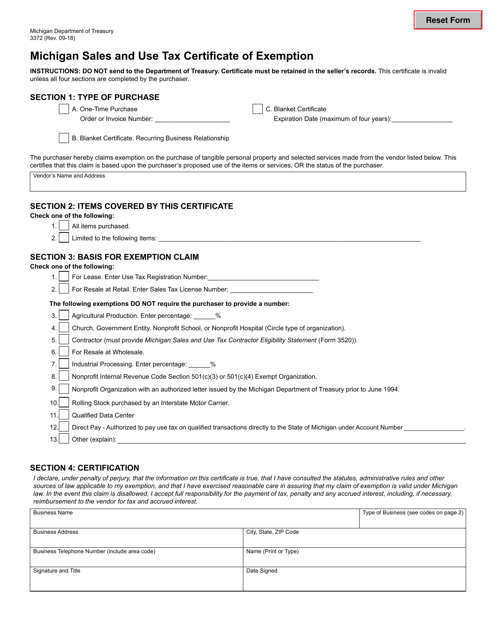

To learn more see a full list of taxable and tax-exempt items in Michigan. Contractor must provide Michigan Sales and Use Tax Contractor Eligibility Statement Form 3520. Michigan Department of Treasury 3372 Rev.

The maximum local tax rate allowed by. Ad New State Sales Tax Registration. Additional sales excluded from tax.

Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction. This exemption claim should be completed by the purchaser provided to the seller and is not valid unless the information in all four sections. Research Michigans sales tax laws to identify sales tax exemptions exclusions and their requirements for manufacturers.

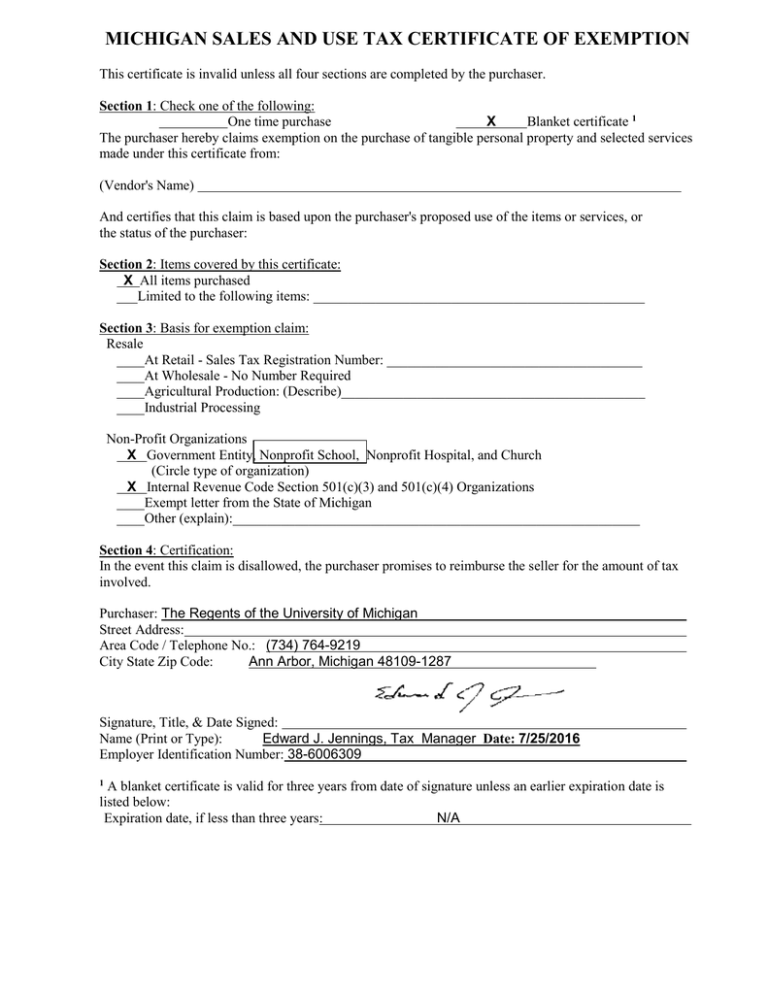

Church Government Entity Nonprot School or Nonprot Hospital Circle type of organization. The word acquire is defined in Blacks Law Dictionary 8th ed to mean to gain possession or control of. Exempt from sales or use tax to a use that is not exempt from tax Acquisition of tangible personal property does not automatically subject a contractor to Use Tax liability.

Sales of vehicles to members of armed forces. As with sales tax two exemption avenues were established by Public Act 424. The state of Michigan levies a 6 state sales tax on the retail sale lease or rental of most goods and some services.

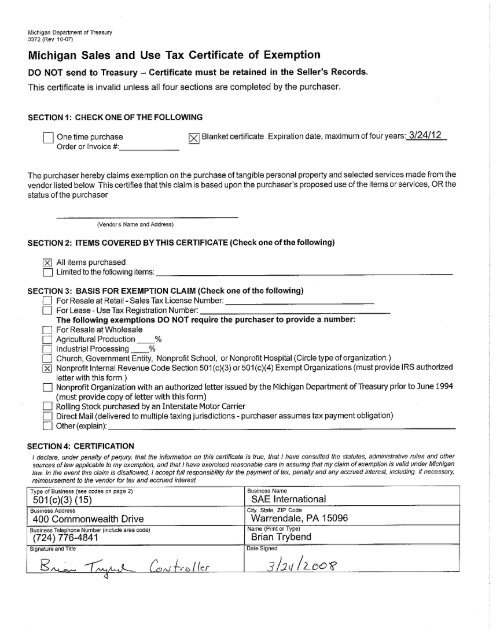

In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The exemption was expanded to all federal income-tax-exempt organizations under section 501 c3 or 501 c4 of the Internal Revenue Code IRC. Form 3520 Michigan Sales and Use Tax Contractor Eligibility Statement for Qualified Nonprofits.

Commissions paid to entities exempt under MCL 20554a. The first was a. According to the General Sales Tax Act Section 20554s a sale of investment coins and bullion is exempt from the sales tax.

Acquisition is not equivalent to ownership. Contractor must provide Michigan Sales and Use Tax Contractor Eligibility Statement Form 3520. Michigan has a statewide sales tax rate of 6 which has been in place since 1933.

T 1 215 814 1743. Rules and Regulations for the State of Michigan Sales Tax Law. The University of Michigan as an instrumentality of the State of Michigan is exempt from the payment of sales and use taxes on purchases of tangible property and applicable rentals.

01-21 Michigan Sales and Use Tax Certificate of Exemption. Michigan defines industrial processing as the activity of converting or conditioning tangible personal property by changing the form composition quality combination or character of property for ultimate sale at retail or for use in the manufacturing of a product. Form 3372 Michigan Sales and Use Tax Certificate of Exemption.

20 rows Sales Tax Exemptions in Michigan. In Michigan the sales tax applies to the full price of the vehicle without considering trade-ins. The Michigan Department of Treasury recently issued Revenue Administrative Bulletin RAB 2019-15 revising its guidance regarding the application of several new sales and use tax laws to the construction industry.

Background Over the past several years the Michigan legislature has been active in addressing the Michigan. Both of these documents are required to be completed for the retailer selling the materials to the contractor to keep in their files. Some customers are exempt from paying sales tax under Michigan law.

Several examples of exceptions to this tax are vehicles which are sold specifically to relatives of the seller certain types of equipment which is used in the agricultural business or some types of industrial machinery. The following exemptions DO NOT require the purchaser to provide a number. What is Exempt From Sales Tax in Michigan.

LR 2002-02 Sales and Use Tax Medical Equipment Exemption. Streamlined Sales and Use Tax Project. The General Sales Tax Act by Public Act 156 of 1994 for sales to nonprofit organizations.

Provides a 2800 special exemption for each tax filer or dependent in the household who is deaf paraplegic quadriplegic hemiplegic totally and permanently disabled or blind. To claim exemption from Michigan sales or use tax that contractor must provide a completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption and provide a copy of Form 3520 that you received from your customer. Examples include government agencies some nonprofit organizations and merchants purchasing goods for resale.

For Resale at Wholesale. Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act. This page describes the taxability of occasional sales in Michigan including motor vehicles.

Do not send a copy to Treasury unless one is requested. Sales exempt from tax. Tax on sale of food or drink from vending machine.

While Michigans sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing. The following exemptions DO NOT require the purchaser to provide a number.

To get or obtain. Thus the taxable price of your new vehicle will still be considered to be 10000 despite your trade-in accounting for 5000 of the price. In addition to hearing aids hearing aid batteries prescribed eyeglasses and prescribed contact lenses under certain conditions the sales and.

Sales Tax Exemption Michigan information registration support.

Printable Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Michigan Sales And Use Tax Certificate Of Exemption

Services Tax Return Filing Consultants Tax Services Tax Preparation Services Accounting Services

Free 8 Sample Tax Exemption Forms In Pdf Ms Word

Mi Dot 3372 2021 2022 Fill Out Tax Template Online Us Legal Forms

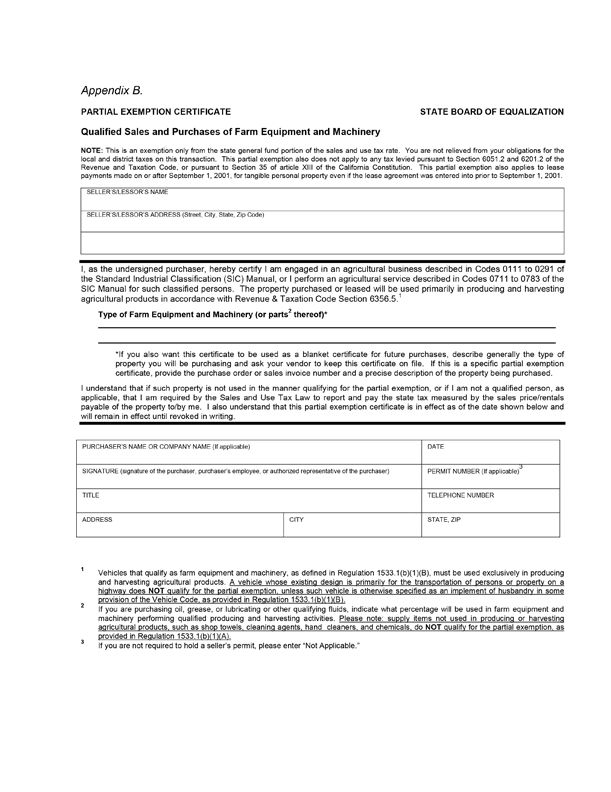

Sales And Use Tax Regulations Article 3

Michigan Sales Tax Small Business Guide Truic

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales Tax Exemptions Agile Consulting Group

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Sales And Use Tax Regulations Article 3

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

Sales Tax Exemption For Building Materials Used In State Construction Projects

Sales And Use Tax Regulations Article 3