iowa inheritance tax rates 2021

The effective tax rates will be reduced an additional 20 for each of the following three years. 50001-100K has an Iowa inheritance tax rate of 12.

Inheritance Tax How It Works How Much It Is Bankrate

IA 8864 Biodiesel Blended Fuel Tax Credit 41-149.

. If you wish to avoid an inheritance tax you can ensure that the net estate is valued at less than 25000. Read more about IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. That is worse than Iowas top inheritance tax rate of 15.

Read more about Inheritance Deferral of Tax 60-038. Change or Cancel a Permit. Apr 30 2022 by victorian government 1992 Comments Off on.

The first 500 of the total of all Masses specified in the Will is exempt from tax. The rate is determined by the amount of the inheritance received and range from anywhere between 5 and 15. Probate Form for use by Iowa probate attorneys only.

This is some text inside of a div block. A bigger difference between the two states is how the exemptions to the tax work. Learn About Property Tax.

Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024. Pursuant to the bill for persons dying in the year 2021 the Iowa inheritance tax will be reduced by twenty percent. Learn About Sales.

0-50K has an Iowa inheritance tax rate of 10. In 2021 the tax rates listed below will be reduced by 20. Inheritance Deferral of Tax 60-038.

In 2022 the tax rates listed below will be reduced by 40. An Iowa inheritance tax return must be filed if estate assets pass to both an individual listed in Iowa Code section 4509 and that individuals spouse. All Major Categories Covered.

The applicable tax rates will be reduced an additional 20 for each of the following three years. Alternatively or in addition you can ensure that the beneficiaries all. Iowa inheritance tax rates 2020 Saturday February 12 2022 Edit.

How much is the inheritance tax in Iowa. For persons dying in the year 2022 the Iowa inheritance tax will be reduced by forty percent. On May 19th 2021 the Iowa Legislature similarly passed SF.

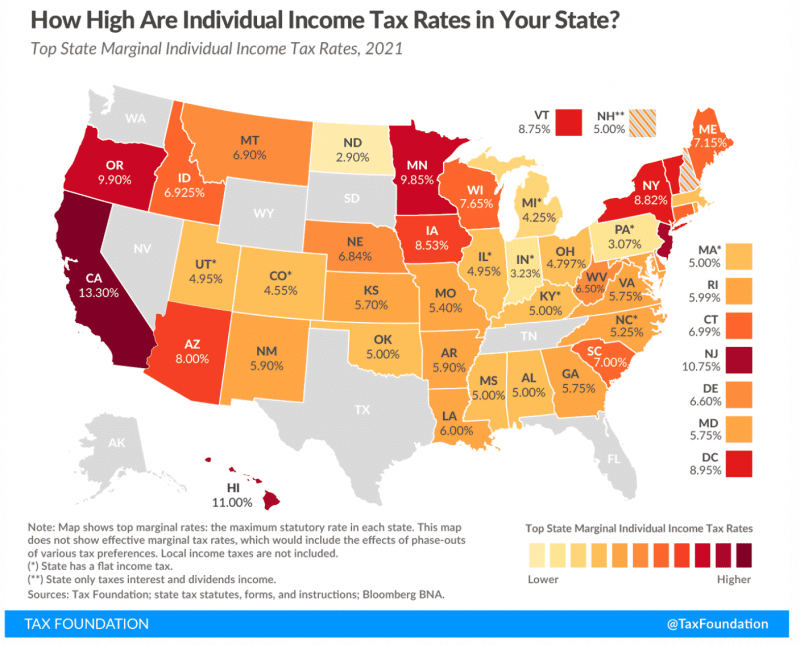

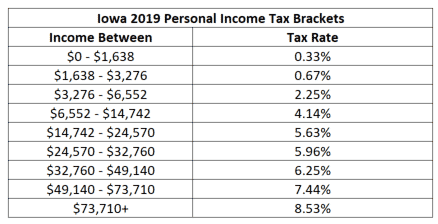

For deaths occurring on or after January 1 2025 no inheritance tax will be imposed. Iowa state income tax rate table for the 2020 - 2021 filing season has nine income tax. It has an inheritance tax with a top tax rate of 18.

Special tax rates apply to these organizations. The federal estate tax exemption increased to 1170 million for deaths in 2021 and 1206 million for deaths in 2022. Read more about Inheritance Tax Rates Schedule.

How Much Will I pay in Iowa Inheritance Tax New Tax Rates. Spouses children and even parents were already excluded from paying the inheritance tax while nieces. In 2023 the tax rates below will be reduced by 60.

The Iowa inheritance tax rate varies depending on their relationship of the inheritors to the deceased person. Effective July 1 2021 for decedents dying on or after January 1 2021 but before January 1 2022 the applicable tax rates listed in Iowa Code section 450101-4 are reduced by 20. Register for a Permit.

Iowa inheritance Tax Rate B 2020 Up to 12500. As part of the reform bill Governor Reynolds signed into law on June 16 2021 Iowas inheritance tax will be phased out over four years. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

December 10 2021. Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025. For deaths occurring on or after.

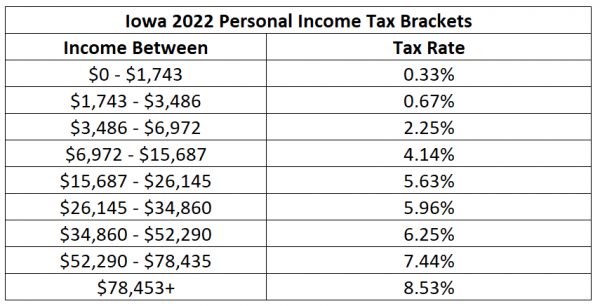

Though you wont owe a state-level estate tax in Iowa the federal estate tax may apply. The legislation also removes revenue triggers implemented in the 2018 tax reform law to further drop the income tax rates on January 1 2023 with the top rate dropping from 853 percent to 65 percent. A summary of the different categories is as follows.

Iowa inheritance tax rates If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of inheritance up to 8 on the value of inheritances worth more than 150000. And in 2024 the tax rates below will be reduced by 80. Up to 25 cash back For deaths in 2021-2024 Iowa will reduce the estate tax rate by an additional 20 each year until the tax is fully phased out.

08 percent to 16 percent on estates above 1 million. With passage of the new bill if one were to pass away in 2021 the inheritance tax imposed on the inheritor would be reduced by 20 from the original rates. There is no federal inheritance tax but there is a federal estate tax.

If the net value of the decedents estate is less than 25000 then no tax is applied. 619 a law which will phase out inheritance taxes at a rate of 20 per year and completely eliminate the tax by January 1st 2025. File a W-2 or 1099.

Iowa individual income tax rates 2021cortland womens soccer roster 2021. 2022 the effective tax rates listed in Iowa Code section 450101-4 are reduced by 20. This is for siblings half-siblings and children-in-law.

Eliminating the trigger will also reduce the number of tax brackets from nine to four and eliminate federal income tax deductibility if Iowa reached that revenue trigger. For more on beneficiary designation visit this article. Iowa was one of just six states in the country to still impose an inheritance tax.

Penalties can only be waived under limited. For persons dying in the year 2023 the Iowa inheritance tax will be reduced by sixty percent. Track or File Rent Reimbursement.

100001 plus has an Iowa inheritance tax rate of 15 Note that the tax rates have changed since the new law was passed in 2021.

State Death Tax Hikes Loom Where Not To Die In 2021

How To File Taxes For Free In 2022 Money

Roth Ira Traditional Ira Contribution Limits For 2021 And 2022 Tax Brackets Standard Deduction Irs

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

The Growing Threat Of Ransomware Microsoft On The Issues Estate Planning Capitol Building Estate Planning Attorney

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

The Best And Worst States For Retirement 2021 All 50 States Ranked Bankrate Retirement Clark Howard Estate Planning Checklist

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

50 Plus New Homes In North Charleston Brings Traffic Concerns To Congested Road North Charleston Traffic Dorchester

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation