child tax credit 2021 eligibility

Understand that the credit does not. The payment for children.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

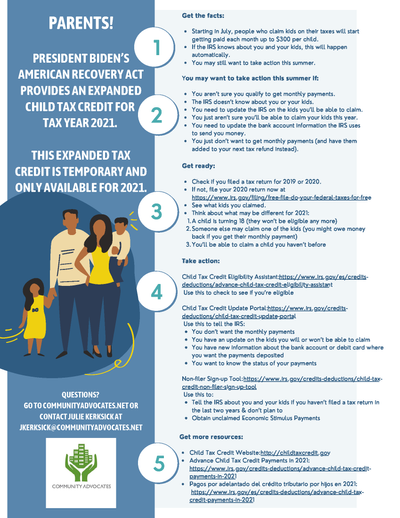

For 2021 eligible parents or guardians can receive up to 3600 for each child.

. Parents with children aged 5 and younger can. 3000 for children ages 6. Married couples filing jointly with an adjusted gross income AGI of 150000 or.

Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. How much is the child tax credit worth. Additionally you will likely be able to claim periodic installments of.

If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying. Parents with children aged 17 years or under are mostly eligible for the new child tax credit. The child and dependent care credit is a tax break to help cover families child care expenses so they can continue working or searching for employment.

Your amount changes based on the age of your children. The maximum amount of payment per month is up to 300 for each child under six and 250 for each child six and older. Individuals must claim the 2021 Recovery Rebate Credit on their 2021 income tax.

But theres another lesser-known credit that rose substantially for the 2021 tax year -- the Child and. Eligible filers will only receive half of the total CTC in the. That work could be for.

In the tax year 2021 under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6. 2 days agoParents who added a child to their family in 2021 may be eligible for a 1400 payment. Ad Free tax support and direct deposit.

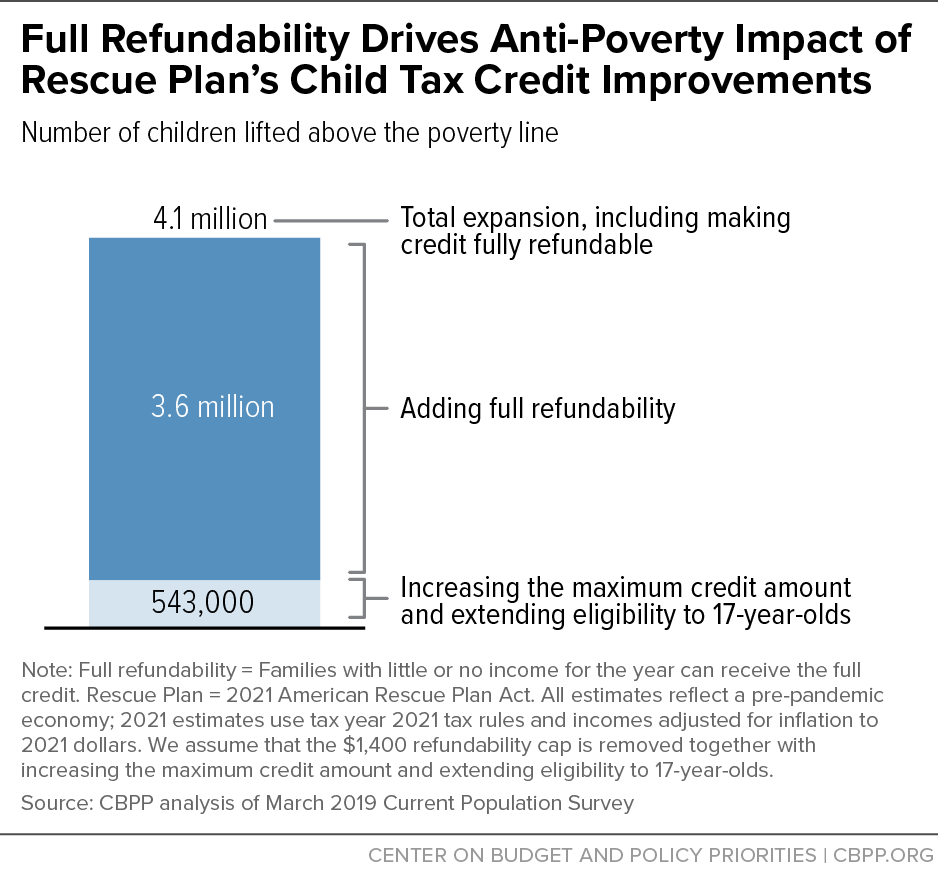

Find out if they are eligible to receive the Child Tax Credit. You may be eligible to receive a fully refundable Child Tax Credit if your income is within the above mentioned threshold. The credit will also be fully.

The expanded 2021 child tax credit is available for people who meet certain income requirements. In previous years 17-year-olds werent. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

3600 for children ages 5 and under at the end of 2021. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Complete IRS Tax Forms Online or Print Government Tax Documents.

Understand how the 2021 Child Tax Credit works. 2 days agoLast year the Child Tax Credit got a lot of press for its major enhancement. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17.

2021 Child Tax Credits eligibility. Ages five and younger is up to 3600 in total up to. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed.

Get the Child Tax Credit.

Did Your Advance Child Tax Credit Payment End Or Change Tas

Child Tax Credit 2021 8 Things You Need To Know District Capital

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities

2021 Child Tax Credit Advanced Payment Option Tas

Arpa Expands Tax Credits For Families

The Big Increase And More Changes To The Child Tax Credit In 2021

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Here S Who Qualifies For The New 3 000 Child Tax Credit

2021 Child Tax Credit Payments Does Your Family Qualify

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit What We Do Community Advocates

Feds Launch Website To Claim 2nd Half Of Child Tax Credit Ktla

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Guide To 2021 Child Tax Credit Amounts Eligibility Becu

Child Tax Credit 2021 8 Things You Need To Know District Capital

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience